What are REITs?

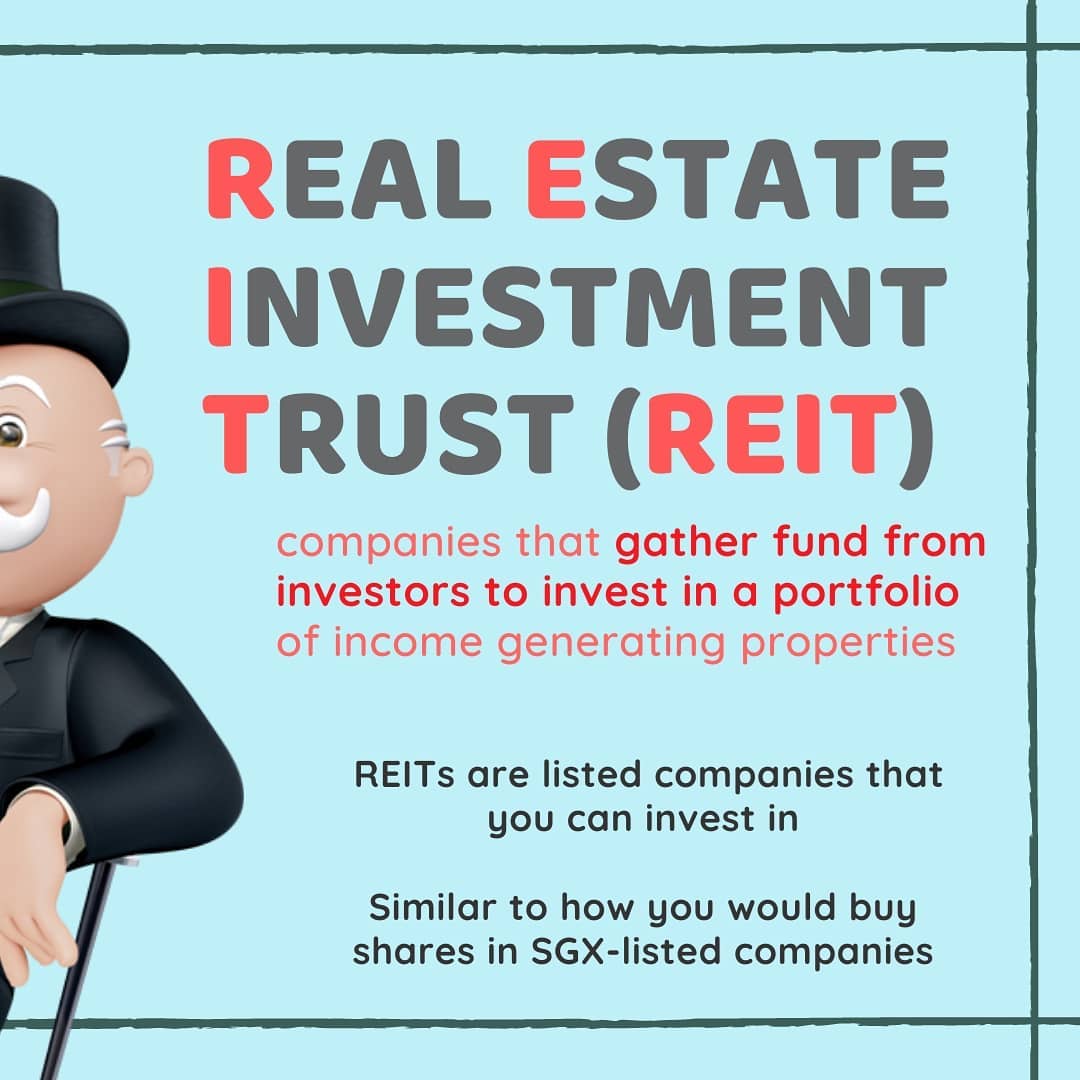

Singapore Real Estate Investment Trusts (S-REITs) are listed entities that pool funds from investors to own, manage, and invest in real estate assets. These trusts provide investors with access to high-quality property portfolios without the need to purchase entire properties themselves.

The properties within a REIT are leased out to tenants, generating consistent rental income. As an investor, you become a co-owner of the REIT, entitling you to a share of this income through regular distributions.

In addition to rental revenue, investors can also benefit from capital gains when the value of the underlying properties appreciates over time. While the term REIT may sound technical to some, most Singaporeans are already familiar with the properties managed by these trusts, such as shopping malls, office buildings, and industrial facilities.

S-REITs have become a popular choice for investors seeking both steady income and long-term capital growth, making them an important component of Singapore’s investment landscape.

REITs in 90 Seconds

Earning Income from Property Without Owning Real Estate

Property can be a dependable source of income, even if you do not physically own any real estate. This is possible through Real Estate Investment Trusts (REITs), which pool funds from investors to acquire and manage income-generating properties such as shopping malls, offices, and industrial spaces.

By investing in REITs, you gain access to regular rental income and potential capital appreciation, without the responsibilities of property ownership.

Watch this video to understand what REITs are and how they can provide you with another reliable stream of income while diversifying your investment portfolio.

Credits: Temasek

Introduction to REITs

How to Invest in REITs in Singapore

REITs are traded like ordinary stocks on the Singapore Exchange (SGX). To start investing in local REITs, you will need two essential accounts: an SGX Central Depository (CDP) account and a stock brokerage account.

If you are a new investor, you can apply for both accounts directly through a local brokerage firm. Most brokers offer a simple application process, and account setup is usually completed in less than seven working days.

If you already have experience investing in the stock market, you likely already hold both accounts. In that case, all you need to do is identify the REIT’s stock code and place your order through your online brokerage platform, or contact your broker to execute the trade on your behalf.

How to spot an ideal REITs?

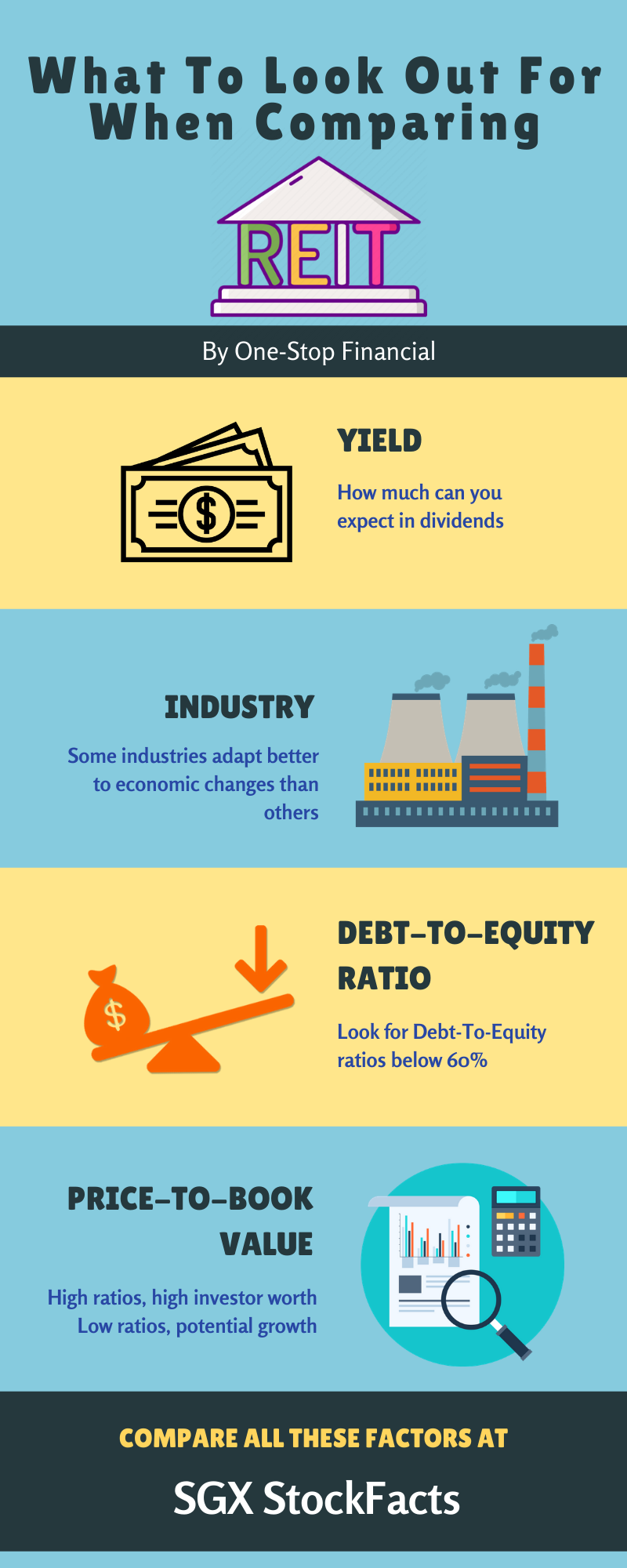

Many investors assume that all REITs are equally safe and that the only real difference lies in the dividend payouts. The truth is that REITs carry the same risks as other stock investments, and proper due diligence is essential before making any decision.

Although REITs are structured differently from direct property ownership, their performance still depends on the ability of the underlying real estate to generate income. Factors such as tenant occupancy, property quality, market conditions, and debt levels can all affect returns.

Just as with traditional property investments, evaluating a REIT carefully is critical. Understanding its financial health, portfolio quality, and management strategy will help you distinguish between a sustainable, income-generating REIT and one that may expose you to unnecessary risk.

By taking the time to research and analyse, you ensure your REIT investments support long-term growth, stability, and consistent income.

REITs worth investing in should have a long-term sustainable outlook within their sub-sectors. This perspective takes into account both macro trends in the industry and financial developments, such as interest rate movements, regulatory policies, and broader market conditions.

One powerful macro trend today is the growing reliance on data science and analytics. As corporations increasingly harvest and process data, the demand for data centres continues to rise. This has created strong growth potential for data centre REITs, which manage and lease out facilities critical to digital infrastructure.

Compared to traditional office REITs, data centre REITs are better positioned to capture this structural shift in demand. By focusing on sub-sectors supported by long-term macro drivers, investors can identify REITs that offer both resilience and growth potential in a changing economy.

The nature of Real Estate Investment Trusts (REITs) sits between the behaviour of stocks and bonds, giving them a unique appeal to investors.

REITs own portfolios of income-generating properties and collect rental revenue from tenants. After expenses are deducted, this income is distributed to shareholders as dividends. Much like bondholders who receive coupon payments, REIT investors enjoy regular quarterly payouts, giving REITs a bond-like feature of steady income.

At the same time, REITs also behave like stocks. Their market value can rise due to speculation, improved valuations, or positive forward outlooks, allowing investors to enjoy capital gains when share prices increase. Market catalysts such as stronger demand, sector growth, or favorable policies can all drive these gains.

Good REIT investments should demonstrate consistent growth in net income on a year-to-year basis. This growth often comes from two main drivers: positive rental reversion and increasing occupancy rates, or through the acquisition and development of new properties that expand the portfolio.

By offering both income stability and capital appreciation potential, REITs remain a versatile option for investors seeking balance between growth and steady returns.

When evaluating REITs, two key metrics often come up: cap rate (capitalization rate) and dividend yield. While dividend yield measures the payout a REIT distributes relative to its market capitalization, the cap rate reflects the rate of return on a property based on its anticipated rental income.

The cap rate is often considered a more reliable indicator of a REIT’s true income-generating capacity. A higher cap rate may signal strong potential for the property or management team to deliver greater rental revenue. It also helps investors separate genuine income performance from situations where accounting practices might make a REIT appear more profitable than it actually is.

By focusing on cap rates in addition to dividend yield, investors can gain a clearer picture of whether a REIT is producing sustainable rental income or simply masking weaknesses. This makes cap rate an essential tool in evaluating whether a REIT is truly a sound investment.

How to Pick the Right REITs

Using SGX Stock Screener to Evaluate REITs

The SGX Stock Screener is a useful starting point for investors exploring REIT opportunities. By selecting the Real Estate sector, you can view a list of REITs and customise the display to include key data points beyond the default settings. This allows you to quickly identify which REITs currently offer the highest dividend yields, giving you an idea of potential income.

However, yield alone should not guide your decision. A REIT that pays high dividends today could face challenges tomorrow. To avoid potential pitfalls, it is important to check indicators of stability such as historical share price performance and the debt-to-equity ratio. Established REITs are generally more stable, and it is uncommon to see them borrowing excessively beyond their means.

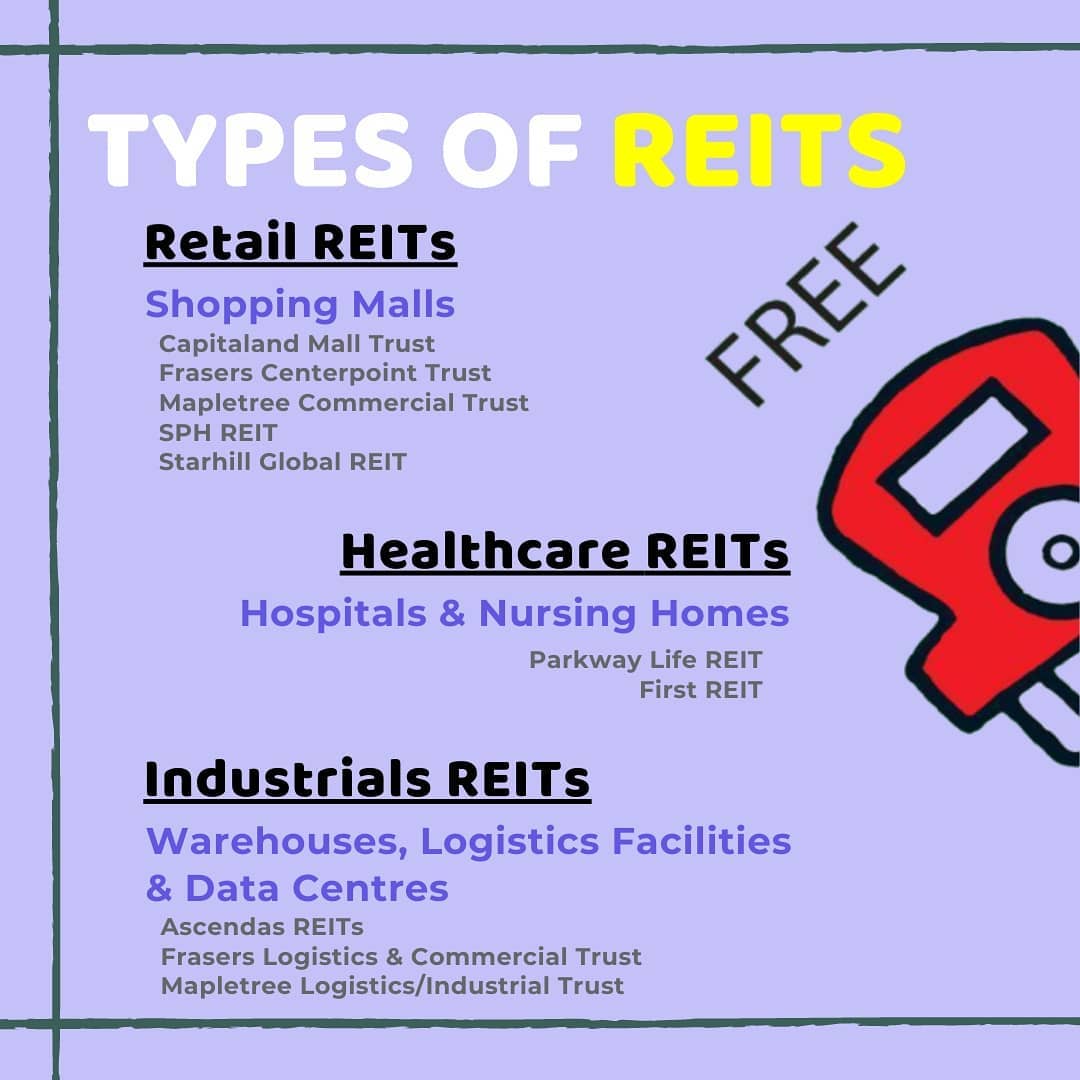

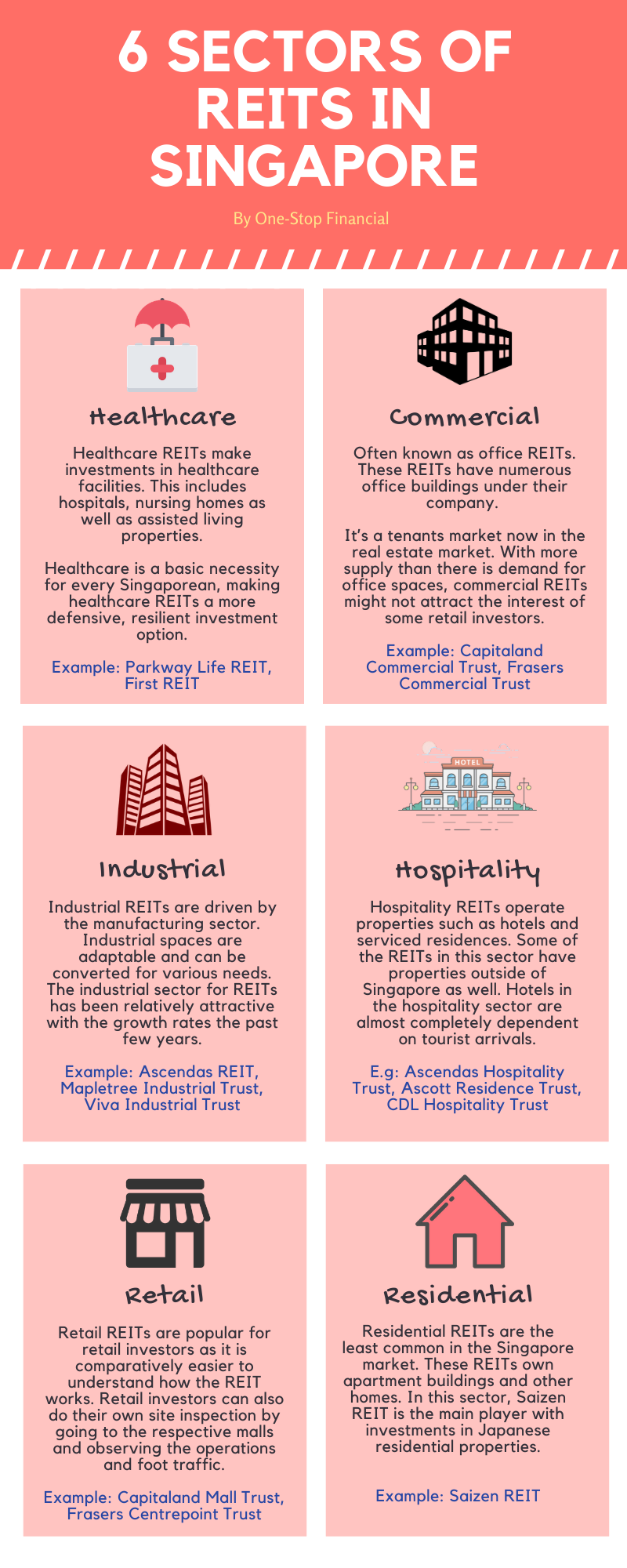

Another crucial factor is the nature of the REIT’s property portfolio. REITs may specialise in industrial, commercial, healthcare, or retail properties, and often operate across multiple countries. Different sectors carry different levels of resilience. For example, in a weaker economy, industrial properties may reduce rental prices to retain tenants, leading to lower income and potentially reduced dividends if the REIT reports operating losses.

Evaluating both financial stability and the property portfolio ensures you select REITs with sustainable income potential and resilience in changing market conditions.

REITs vs Business Trusts: Understanding the Differences

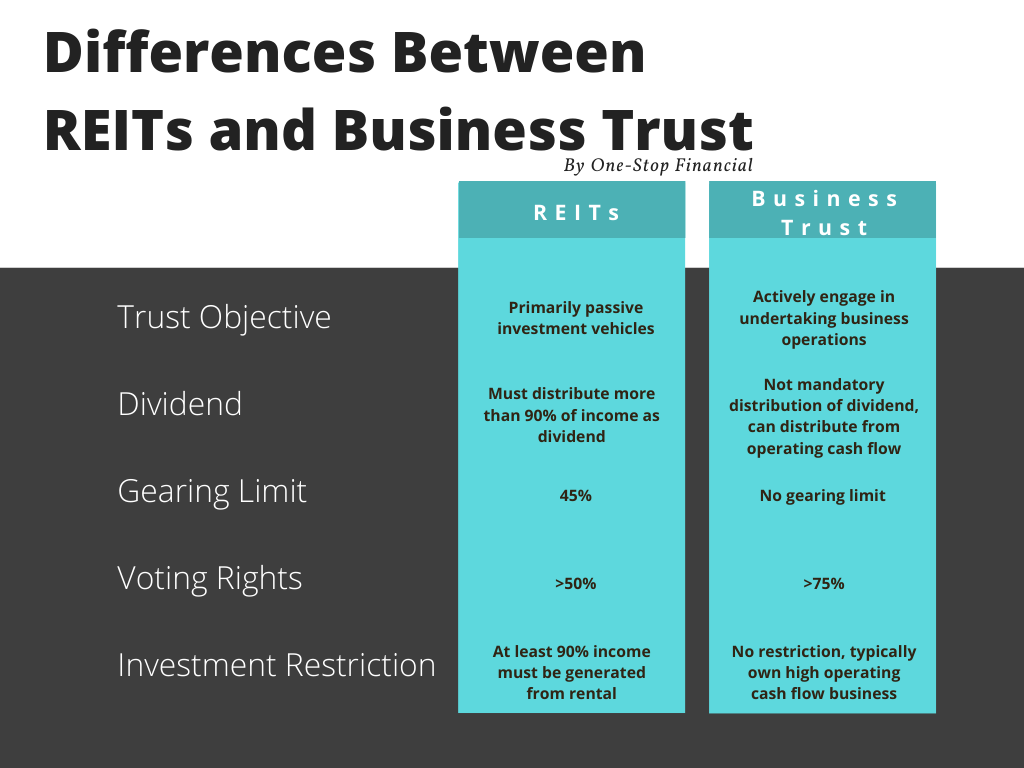

Many investors confuse Real Estate Investment Trusts (REITs) with Business Trusts (BTs) because they sound alike. In reality, the two instruments are quite different in nature, and these differences affect how they behave in the market.

As an investor, understanding these differences is crucial, as they directly influence the dividend payouts you are entitled to and expose you to different levels of risk.

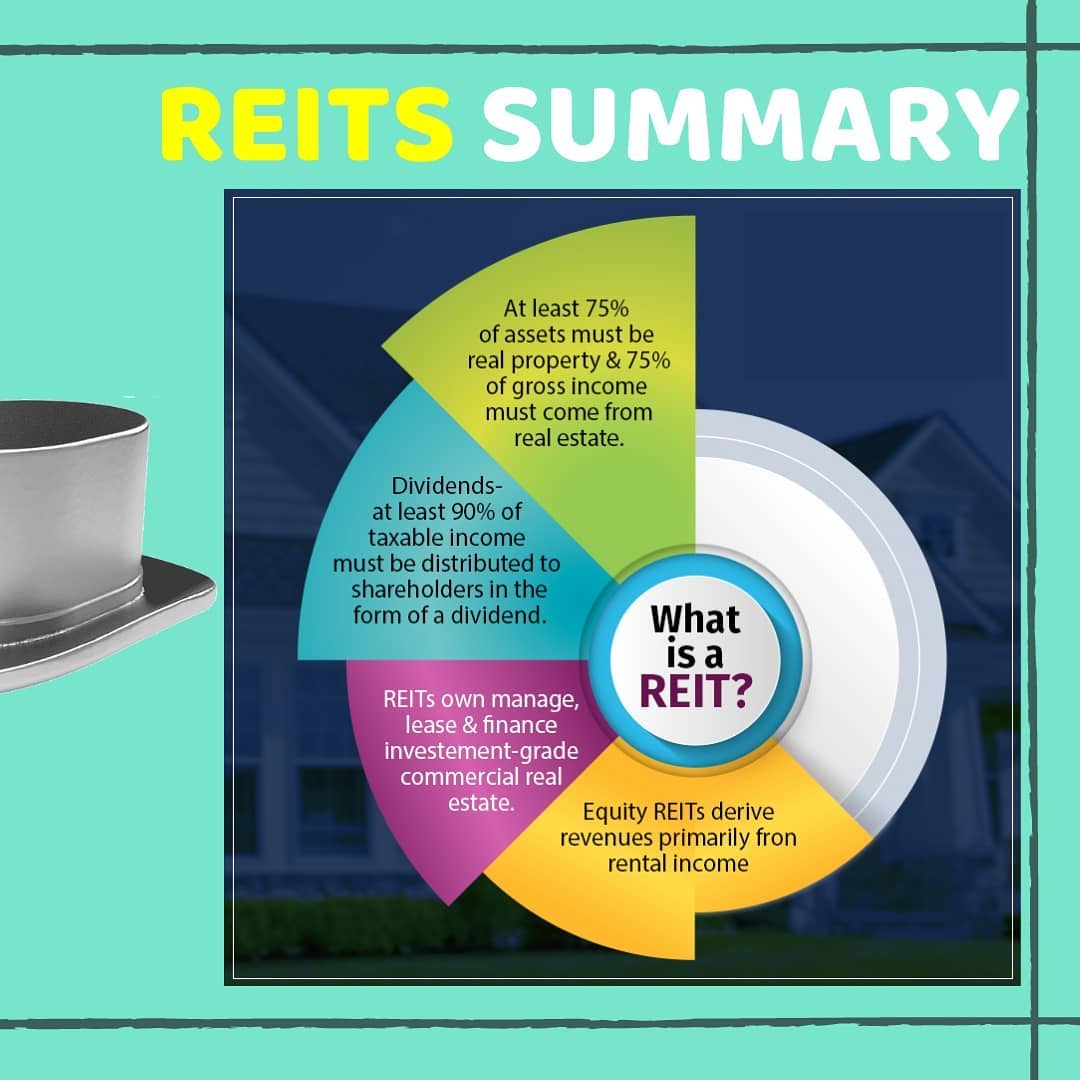

Real Estate Investment Trusts (REITs)

REITs primarily invest in income-generating real estate properties such as malls, offices, and industrial assets.

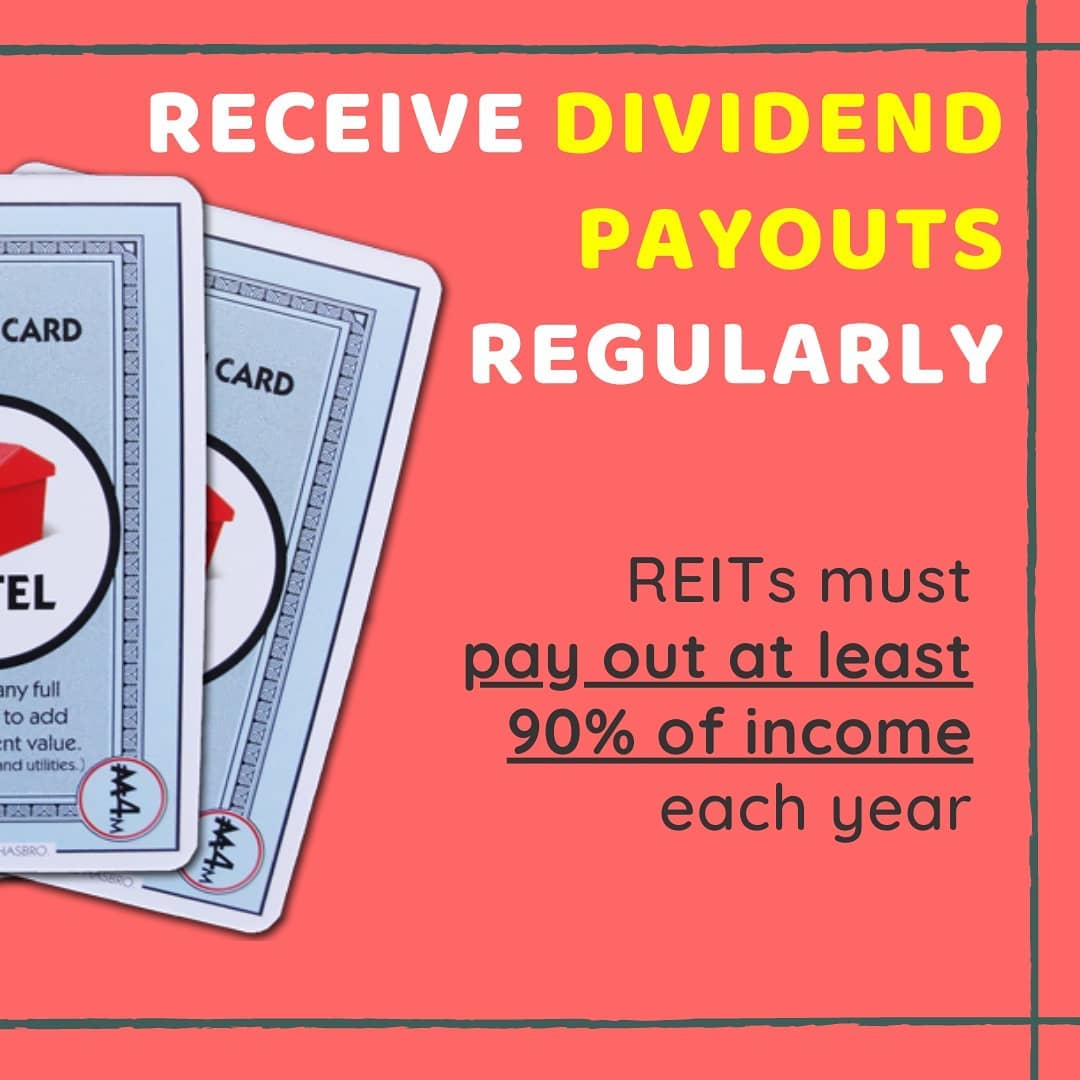

By law, REITs must distribute at least 90 percent of their taxable income as dividends to investors, making them attractive for those seeking consistent income.

They are closely tied to property market performance and interest rate conditions, offering a balance between stable income and moderate growth.

Business Trusts (BTs)

Business Trusts are broader in scope, as they can own and operate a wide range of businesses or assets, including utilities, shipping, and infrastructure, not just real estate.

Unlike REITs, Business Trusts are not legally required to pay out a fixed percentage of their income as dividends. Distribution policies are left to the trustee-manager’s discretion.

This structure often means BTs carry higher flexibility but also greater risk, as distributions can be inconsistent depending on the profitability of the underlying business.

Why It Matters

REITs are generally more suited for investors looking for predictable income with exposure to property assets, while Business Trusts may appeal to those who are comfortable with higher risk in exchange for potentially higher returns.

By recognising the differences, you can choose the vehicle that better fits your risk appetite, investment horizon, and income expectations.

The objectives of REITs and Business Trusts are fundamentally different.

REITs are designed for investors who want passive income. They focus on owning income-generating properties and distributing most of their rental income to shareholders as dividends. This makes them ideal for investors who value consistency and predictability in returns.

Business Trusts, on the other hand, are more operationally driven. Instead of just holding assets, they actively manage and undertake business operations in sectors such as shipping, infrastructure, or utilities. Their payouts depend on the profitability of the business, and distributions can vary significantly.

If your investment goal is to enjoy steady passive income, REITs are generally more suitable than Business Trusts, which may appeal to those seeking potentially higher but less predictable returns.

The rules for dividend distribution differ significantly between Real Estate Investment Trusts (REITs) and Business Trusts.

REITs are required by regulation to distribute at least 90 percent of their taxable income to unitholders. This ensures that most of the rental income generated by their properties is paid out as dividends, making REITs a popular choice for investors seeking predictable passive income.

Business Trusts, however, do not face the same mandatory requirement. While they are not obligated to distribute dividends, they are allowed to make payouts directly from their operating cash flow. This means that even if a Business Trust records a net loss, it can still distribute dividends as long as its operating cash flow remains positive.

Because of this flexibility, Business Trusts often own businesses with strong cash flow generation, such as utilities, shipping, or infrastructure. This structure gives them the ability to provide dividends even during periods of weaker profitability, though it also introduces variability in payout sustainability compared to REITs.

One of the key differences between REITs and Business Trusts lies in their gearing limits, which refer to how much debt they can take on relative to their assets.

For REITs, the maximum gearing limit is capped at 35 percent for non-rated REITs and 60 percent for credit-rated REITs. This regulation ensures that REITs maintain a controlled level of leverage, which helps protect investors by limiting excessive borrowing.

In contrast, Business Trusts do not have a statutory gearing limit. This gives them greater flexibility to take on more debt when expanding or acquiring new businesses. However, this also exposes investors to higher risk if the trust becomes overly leveraged.

The pros and cons of these structures appeal to different investor profiles. The gearing cap on REITs makes them more suitable for investors with a low risk appetite, as it ensures financial prudence and stability. Business Trusts, on the other hand, may appeal to investors with a higher risk appetite, as their unlimited leverage potential can drive higher growth but also introduces greater volatility and downside risk.

Another key distinction between REITs and Business Trusts lies in their voting rights for passing proposals.

For REITs, at least 50 percent of voting rights are required to approve certain resolutions. In contrast, Business Trusts require a higher threshold of 75 percent of voting rights to pass proposals.

This difference affects how controlling interests are established. In the case of a Business Trust, an investor holding just over 25 percent ownership effectively has controlling influence, since only 75 percent approval is required. As a result, Business Trusts tend to have a higher free float and greater flexibility to raise funds through issuing units to public investors.

This structural difference highlights why Business Trusts may attract a broader investor base, while REITs offer a governance model that balances control with stability.

A significant difference between REITs and Business Trusts lies in their income requirements.

For REITs, at least 90 percent of income must be generated from rental revenue derived from their property portfolios. This ensures that their distributions are primarily tied to stable, property-based earnings.

In contrast, Business Trusts have no such restriction. They can generate income from a wide range of business activities, giving them more flexibility in operations and revenue streams.

However, this difference can be a double-edged sword. If the property market experiences a downturn, the income of REITs may decline significantly, which could lead to lower dividend payouts for unitholders. Business Trusts, while more flexible, may engage in higher-risk activities that do not always guarantee consistent income.

For investors, this highlights the importance of aligning your choice with your risk appetite and income expectations. REITs provide predictable, property-linked income, while Business Trusts may offer higher growth potential but with less certainty.

The choice between REITs and Business Trusts depends entirely on your investment objectives.

If your goal is to earn passive income with predictable dividends, REITs are generally the better choice. Their structure requires a high percentage of income to be distributed to unitholders, making them attractive for investors seeking stability and regular payouts.

On the other hand, if you are aiming for higher potential returns and are comfortable taking on more volatility and risk, Business Trusts may suit your portfolio. They offer greater flexibility in operations and income generation, which can sometimes lead to stronger returns, though with less predictability and higher exposure to market fluctuations.

In short, REITs are ideal for investors who value steady income and lower risk, while Business Trusts appeal to those who prioritise growth potential and are willing to accept greater uncertainty.

How to Screen and Filter REITs Funds

If you are new to investing, the SGX REITs screening platform is a great place to start when shortlisting potential investments. This tool allows you to filter and compare different REITs based on your specific needs and preferences.

With the SGX Stock Screener, you can easily review details such as asset class, geographical exposure, benchmark index, and fund manager information. This makes it simple to compare REITs side by side and identify those that align with your financial goals.

The best part is that you do not need to register or sign up to use the platform. Simply visit the SGX Stock Screener, select Sector and choose Real Estate, and you will have access to a wide range of REITs data instantly.

Which REITs Are Best Suited for You?

While our intention to invest is to generate profits, we also need to be intelligent in selecting the correct strategies that make sense to you. Here are some variables to consider before deciding on the investment strategy that works best for you.

Grow Your Assets with Expert Financial Guidance

Give your assets the opportunity to grow with a strategy designed for long-term success. With our expertise, we will work closely with you to formulate and implement a personalised investment plan that aligns with your financial goals.

At One Stop Financial, we are your trusted partner in asset management and investment advisory. Together with our network of highly qualified partners, we provide a comprehensive suite of wealth planning services, ensuring that your financial future is well-structured, secure, and built for sustainable growth.