For a start, do you even know what insurance really means?

How Did Insurance Come About?

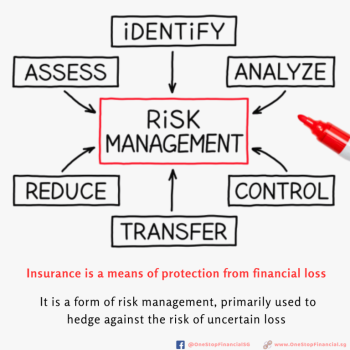

What is Risk Management?

Risk Pooling: The Core of Insurance

The fundamental principle of insurance is risk pooling. Policyholders contribute premiums into a shared pool, which is then used to compensate those who experience an insured event, such as an accident, critical illness, or death. This collective approach spreads financial risk among many individuals, making it more affordable and sustainable.

Risk Transfer: The Foundation of Insurance

Insurance also works on the principle of risk transfer, a key risk management technique. This means shifting potential financial losses from one party to another. Individuals transfer risk to insurance companies by paying premiums, while insurers may transfer part of their risk to reinsurers.

Through risk pooling and risk transfer, insurance provides stability and protection, ensuring that no single person bears the full financial impact of unforeseen events.

No Holding Back with Insurance

Watch this to find out how you can keep your money safe from unforeseen events.

When you are young and carefree, it is easy to believe that everything will work out on its own. At that stage, the idea of buying insurance often feels distant or unnecessary. Yet in reality, getting your insurance portfolio in order is one of the smartest financial decisions Singaporeans can make and it is best done while you are still young and healthy.

Insurance provides the foundation of financial security, protecting you and your loved ones from unexpected challenges such as illness, accidents, or income loss. Securing coverage early not only ensures lower premiums but also shields you from potential exclusions that may arise later due to health conditions.

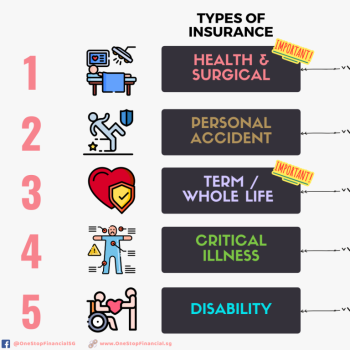

Did you know there are more than 20 different types of insurance available today? While that may sound overwhelming, most of us are already familiar with the common ones, such as:

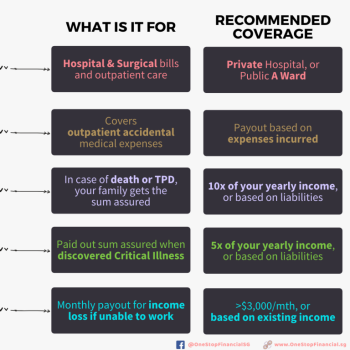

Health Insurance for medical expenses and hospitalisation

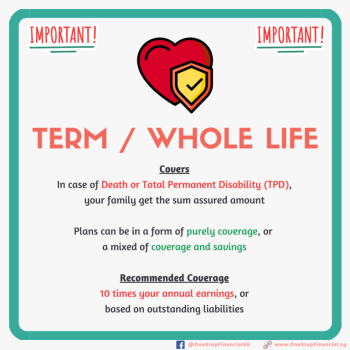

Life Insurance to protect loved ones financially in the event of death or disability

Motor Insurance for vehicles and drivers

Travel Insurance for protection against trip disruptions and emergencies

Home Insurance for property and belongings

Building the right portfolio means understanding which types are essential for your stage of life and tailoring your coverage to match your needs and goals.

Select a category to begin

Financial Planning Is Not Just About Insurance

Most Important Types of Insurance

Let’s Start Something Together

At One Stop Financial, we are your trusted partner for comprehensive financial solutions, offering all your insurance needs under one roof.

Through our wide network of established insurance partners, you gain access to a full suite of products and services tailored to protect every stage of your life. From health and life protection to motor, travel, and business insurance, we simplify the process of securing coverage so you can focus on living with peace of mind.

Start your journey with us today and experience the convenience of a one-stop platform designed to safeguard your future.