How to Start Investing in Singapore

Your Beginner’s Guide to Investing

If you are new to investing and unsure where to begin, this guide is written to help you take the first step with confidence. It is a simple, beginner-friendly introduction that explains the basics of investing and sets you on the right path to building long-term wealth.

With clear explanations and practical insights, you will learn how to approach investing in a way that is accessible and easy to understand.

Why Investing Is Essential to Financial Freedom

Investing is one of the core foundations of personal finance. By learning how to invest and applying that knowledge with discipline, you can accelerate wealth growth and create dependable streams of passive income.

Those who invest successfully often enjoy the freedom to retire earlier, pursue their passions, and live with confidence. With a well-structured investment plan, there is no need to fear outliving your savings. Your money continues to work for you, building long-term financial security and peace of mind.

How Comfortable Are You with Taking Financial Risks?

Understanding Your Risk Appetite

Every investor has a different level of comfort when it comes to risk. Identifying your risk appetite is the first step toward building an investment portfolio that aligns with your goals and financial situation.

From low-risk options that provide stability to high-growth opportunities that carry greater volatility, every investment product offers its own balance of risk and reward. By understanding where you stand, you can choose the investments that best match your comfort level and long-term objectives.

5 Things to Do Before Investing

From Knowing to Doing: How to Begin Investing in Singapore

You may already be familiar with the common types of investment products and how they work. The bigger question is: how do you actually take the first step toward investing in Singapore?

This video is designed to guide you through the initial steps of becoming an investor, giving you the clarity and confidence to start your financial journey.

Before you can begin investing in Singapore, you will need to open a Central Depository (CDP) account. This account is where all the stocks you purchase on the Singapore Exchange (SGX) are held under your name. To be eligible, you must be at least 18 years old and not be an undischarged bankrupt.

To start your investment journey, two essential accounts are required:

1. SGX CDP Account

Holds your securities in your own name, ensuring safe custody of the shares you purchase.

2. Brokerage Account

Facilitates the buying and selling of investments, linking directly to your CDP account for smooth transactions.

Together, these accounts provide a secure and efficient way to manage your investments in Singapore.

Getting Started as a First-Time Investor

If you are a first-time investor, you can apply for both a CDP account and a brokerage account directly through a local brokerage firm. Most brokers offer a simple and streamlined application process, with account setup usually completed in under seven working days.

If you have invested in the stock market before, you likely already hold both accounts. In that case, you only need to review your investment options and execute trades through your online brokerage platform or with the guidance of a trusted advisor.

The Importance of Due Diligence

You may have come across financial advice or investment tips online that sparked your interest. While certain opportunities may appear promising, it is essential to conduct your own due diligence before making any financial commitments. Proper research protects you from unnecessary risks and ensures you make informed choices.

Investing to Beat Inflation

If you are ready to take the next step, you are also prepared to invest with the goal of beating inflation and potentially achieving stronger returns over time. With the right guidance, knowledge, and mindset, investing can be a powerful way to grow your wealth and secure your financial future.

Why Should We Invest?

Outpacing Inflation Through Smart Investing

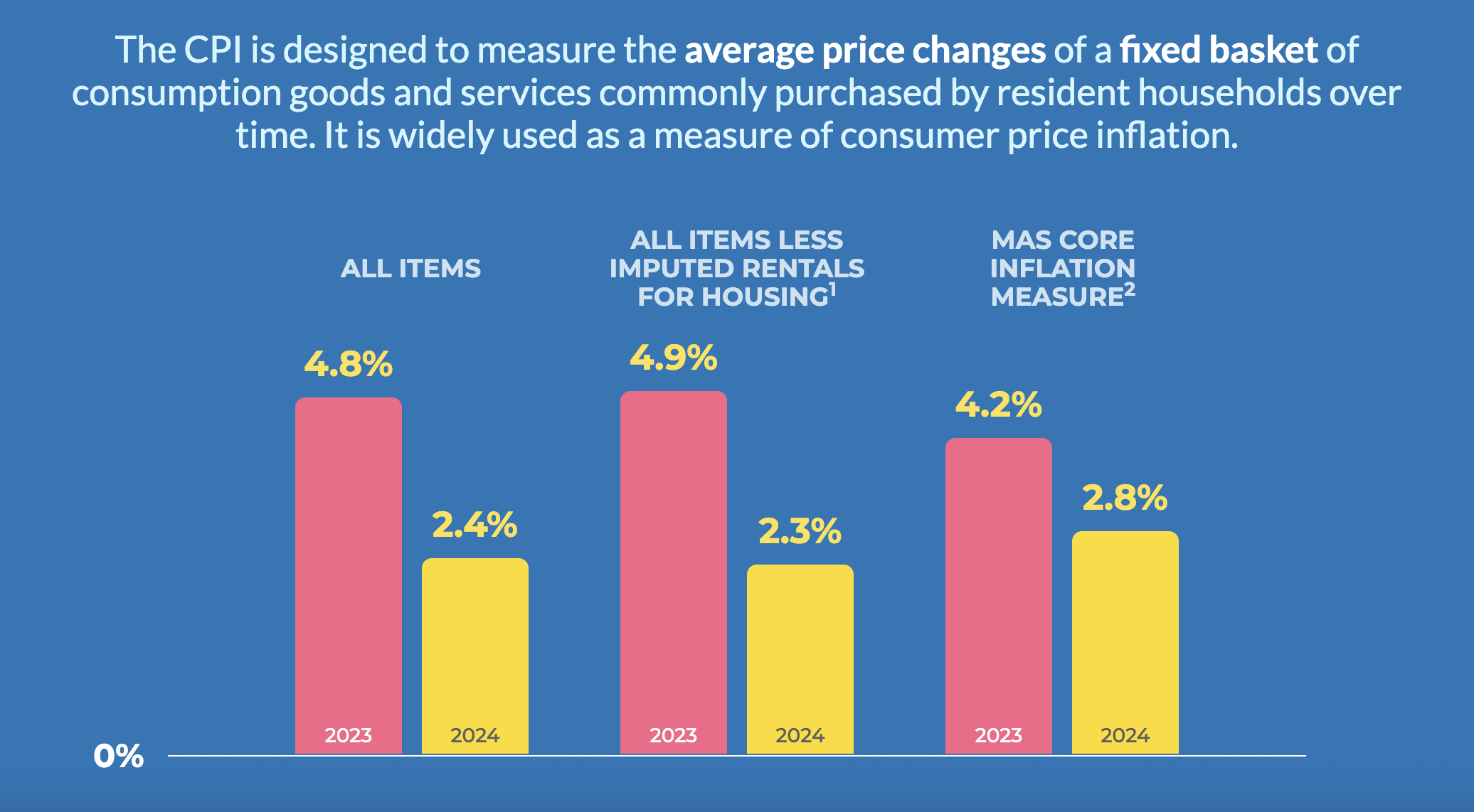

Your financial goal should be to outpace inflation, which currently averages about 3 percent annually (source).

You have two clear choices:

1. Savings Account

Keep your money in a savings account, where it may gradually lose value over time as inflation erodes its purchasing power.

2. Investing for Growth

Adopt a long-term, passive investment mindset that focuses on sustainable growth and wealth accumulation.

The choice you make today can create a meaningful difference in your financial future, helping you build security and confidence for the years ahead.

It is not simply about retiring early or walking away from your job. True financial independence means being fully self-sufficient and no longer relying on work as your primary source of income.

This level of freedom allows you to live life on your own terms, make decisions based on your passions and values, and pursue the lifestyle you truly desire. For many, this is the ultimate financial goal and a milestone worth striving for.

Over time, the value of money declines, meaning you can buy less with the same amount. Whether you are working, eating, or sleeping, your wealth is constantly eroded by inflation.

In Singapore, the average inflation rate is about 3 percent, while the average bank savings rate is below 0.5 percent. This results in a loss of more than 2 percent in purchasing power every year.

If you leave your money uninvested, it could lose over 60 percent of its value by the time you turn 60. This is a powerful reason to begin investing now so you can preserve your wealth, grow your assets, and build a financially secure future.

Two Possible Financial Paths: Growth or Decline

Your financial future depends on whether your returns can outpace inflation.

Positive Exponential Growth

When your investments consistently generate returns above the inflation rate, your wealth compounds and grows steadily over time. This creates the foundation for greater financial freedom and long-term security.

Negative Exponential Growth

If your returns fail to keep pace with inflation, the value of your money erodes year after year. Left unmanaged, this decline can lead to financial strain or even debt.

The path you take is shaped by the financial decisions you make today. Choosing wisely can mean the difference between sustainable growth and gradual decline.

One of the main reasons individuals seek our guidance is to ensure they are financially prepared for a secure and comfortable retirement.

Many people are increasingly concerned that their personal savings, and even their CPF balances, may not be enough to support the lifestyle they envision in their golden years. This is why strategic investing plays such a critical role.

By building a retirement plan that goes beyond basic savings, you can bridge the gap between what you have now and the future you desire. With the right approach, your retirement strategy can provide lasting security and allow you to enjoy life with confidence and peace of mind.

The Truth About Investment Returns and Getting Rich Through Investing

A common question we hear is: “Is there an investment strategy that beats the market, generates monthly passive income, requires little capital, and carries no risk?”

The honest answer is no. Investing alone will not make you instantly wealthy or replace your full income unless you already have substantial capital that can compound meaningfully over time.

Smart investing is about steady long-term wealth building, not chasing shortcuts. It takes patience, discipline, and the right strategy to benefit from compounding. Over time, these consistent actions can create financial stability, generate passive income, and eventually give you the freedom to live life on your own terms.

Start Small, Learn Early, Grow Confidently

In the early stages of your investing journey, it is often wiser to begin with a small amount of capital. Mistakes are part of the learning process, and it is far better to make those mistakes when the stakes are low rather than risk significant losses later.

By starting early, you give yourself the opportunity to build the knowledge, discipline, and mindset that are essential for long-term success. When your capital eventually grows, you will already have the skills and confidence needed to invest wisely and achieve sustainable financial growth.

Low Risk and High Risk Investments

Understanding Investment Risk

Every investment carries a certain level of risk. Some financial products provide capital guarantees, but many do not.

If you are considering securities such as stocks, bonds, or unit trusts, it is important to remember that these assets can fluctuate in value. This means you may risk losing part, or even all, of your invested capital.

Before making any investment, always take the time to understand the risks involved and assess whether they match your financial goals, time horizon, and risk tolerance. Informed decisions are the foundation of long-term financial success.

Important Note

All investments involve some degree of risk. Risk refers to the possibility of losing part or all of your invested capital as a result of changes in the financial markets.

Before committing to any investment, it is essential to understand these risks, evaluate your own risk tolerance, and ensure that the products you choose are aligned with your financial goals and time horizon.

What Can You Invest In? A Guide for Singapore Retail Investors

One of the most common questions new investors ask is: What can I actually invest in? The good news is that the answer has never been clearer.

Today, retail investors in Singapore enjoy access to a wide variety of investment products. From familiar instruments such as stocks, unit trusts, REITs, and ETFs, to less common choices like bonds, the range of opportunities is extensive.

The key is to choose investments that align with your risk tolerance, financial goals, and time horizon. Always remember the golden rule: never invest in something you do not fully understand. Clarity and confidence are essential for long-term success and financial growth.

Unit Trusts (UTs) are pooled investment vehicles where your money is combined with contributions from other investors and allocated across a diversified portfolio of assets. Each fund follows a stated investment objective and strategy, giving investors access to a professionally managed portfolio that might otherwise be difficult to build individually.

In Singapore, unit trusts operate under a trust structure, although not all investment funds use this framework. Both local and foreign unit trusts offered to retail investors are regulated as Collective Investment Schemes under the Monetary Authority of Singapore (MAS), ensuring transparency and investor protection.

Most unit trusts are actively managed by professional fund managers who aim to outperform a benchmark index. These managers make strategic decisions on asset allocation, timing, and selection, allowing investors to benefit from professional expertise.

Unit trusts are suitable for those seeking professional oversight, diversification across multiple markets, and long-term capital growth aligned with their financial goals.

Bonds are debt securities that provide stable and predictable returns, making them a popular choice for risk-averse investors. When you purchase a bond, you are essentially lending money to a government or corporation for a specified period. In return, you receive periodic interest payments, also known as coupons, along with the repayment of your principal at maturity.

In Singapore, investors have access to a wide variety of bonds, including government bonds, corporate bonds, and retail bonds. Each carries a different balance of risk and return, offering options for both conservative and moderate investors.

It is important to understand that risk and return go hand in hand. Bonds with higher coupon rates often come with higher levels of risk. While bonds are generally considered safer than stocks, they are not completely risk-free. You could lose your entire investment if the issuer defaults, declares bankruptcy, or is liquidated.

Before investing, always review the issuer’s creditworthiness and the specific terms of the bond to ensure it aligns with your financial goals and risk tolerance.

Forex Trading: High Risk and High Volatility Currency Investing

Forex trading, also known as foreign exchange trading, involves buying and selling currency pairs such as EUR/USD, GBP/USD, or USD/SGD. The goal is to profit from fluctuations in exchange rates by buying low and selling high as market conditions change.

While forex trading can be attractive due to its high liquidity, 24-hour market access, and relatively low transaction costs, it is very different from traditional stock investing. The forex market comes with greater leverage, higher volatility, and increased counterparty risk.

Traders must be extremely cautious, as positions can shift rapidly, sometimes even overnight. Although there is potential for profit, there is also the risk of substantial losses, particularly for those without a clear strategy or proper risk management.

Forex trading can be rewarding for experienced investors, but it requires knowledge, discipline, and careful planning to manage its risks effectively.

![]()

The CPF Investment Scheme (CPFIS) gives CPF members the opportunity to invest their CPF savings in a variety of financial instruments, including insurance products, unit trusts, fixed deposits, bonds, and shares. The purpose of CPFIS is to help members grow their CPF balances while supporting the long-term objective of financial security during retirement.

Members can choose to allocate a portion of their CPF balances into these approved products. Any returns earned are credited back into the CPF account, ensuring that your savings continue to serve your future retirement needs.

Since CPF savings are primarily meant for retirement, investments made under CPFIS should always be approached with a long-term perspective. Careful planning and understanding of each product’s risks are essential to maximising growth while safeguarding your financial future.

Key Considerations Before You Invest

Aligning Investments with Your Risk Profile

Understanding the risks linked to different investment options is essential for making informed financial decisions. Each product carries its own level of risk and reward, and by carefully evaluating these factors, you can choose investments that align with your risk tolerance, financial goals, and personal circumstances.

This alignment ensures you are not only comfortable with your investment choices but also confident in your long-term strategy. Building a portfolio that matches your profile creates the foundation for more effective and sustainable wealth growth.

Assess Your Comfort Level with Investment Risk

Before making any investment, it is important to evaluate how much risk you are both emotionally comfortable with and financially able to take on. Ask yourself if you can tolerate short-term market fluctuations or temporary losses, and whether you have sufficient funds set aside to absorb potential risks without affecting your lifestyle.

To gain clearer insight, completing a Risk Tolerance Questionnaire can be helpful. It allows you to understand your personal risk profile more accurately and guides you toward investment options that align with your financial situation and long-term goals.

Matching Investment Duration with Your Financial Goals

The length of your investment horizon plays a crucial role in shaping the right strategy. For example, CPF savings are designed primarily for retirement, making them most suitable for long-term investments that have time to grow and compound.

On the other hand, if you are nearing retirement or focusing on shorter-term financial goals, your investment approach should reflect the reduced timeframe and a lower tolerance for risk.

By aligning the duration of your investments with your financial objectives, you can stay on track with both your risk appetite and expected returns, creating a strategy that is realistic, balanced, and sustainable.

Evaluate Your Retirement Needs and Financial Commitments

When planning your investment strategy, it is important to consider your ongoing financial obligations and the cash flow required to maintain your desired lifestyle in retirement. Ask yourself whether you have other sources of retirement income in addition to your CPF savings, such as investments, property, or supplementary plans.

Starting your investment journey may feel overwhelming at first, but with the right tools, professional guidance, and a clear investment philosophy, you can approach each decision with confidence. Careful evaluation ensures that your strategy not only supports your current commitments but also builds a solid foundation for long-term financial security.